Harsh Truths about Laissez-faire (Free Trade).

Business Philosophy of the WASPs

WASPs expand as “White Anglo Saxon Protestants”, neither a

religious nor an ethnic group but a business culture of the Western Europe that

encourages innovation, exploration and passion for achievement and growth. They

prefer a strong capitalism with least interference from the government. Armed

by two ideologies, democracy and Laissez-Faire (‘let do and let pass’ meaning

deregulated free trade), world economy has been under their direction for the

last 400 years. It is empowerment of the corporate sector to run the economy.

Anglo Saxon governments, generally well organized, provide political and military

support to their businesses under any circumstance - and at all levels - to

secure their interest and domination in world commerce/industry/trade. The USA stands as an extreme example of pure

Laissez-faire.

The strong belief in

Anglo-Saxon economies is to create and keep increasing shareholder/owner’s

value. The survival

and success of the CEOs depend only upon their ability to maximise it. In

recent years financial experts capable of

manipulating figures and play in

speculative deals are preferred as CEOs.

Economic approach in the rest of the world is more after

equality than wealth. Stake holders (employees, creditors, customers,

government and public) are respected as partners in progress and not viewed as

an unavoidable burden. It l has a social quality and social nets so that

workers are not being reduced to cost factors. Anglo Saxons strongly believe

that liberalised economies welcoming foreign capital and skilled labour produce

greater overall prosperity, while the others counter argues that regulated

economy will produce lesser inequality and lesser poverty at the lowest

margins.

WASP philosophy strongly advocates self reliance and initiative.

During the great economic depression in 1929, the Anglo Saxon pundits advised

that Government charity, especially robbing people of initiative, would be a

great error. President Herbert Hoover

warned that American people should not look for help from the Federal Treasury

even during national crisis as it might become a practice in future. When there

was vociferation that 600 families control and enjoy the wealth of America, he

said “confiscation

of wealth may satisfy the vengeful in us and may soothe a retaliatory spirit.

But it is the path of national suicide. Objectives of planned economy should

not be made to depend upon popular decision.

Planners must control the people and be vested with full authority.”

Many government regulations introduced

under the New Deal progamme to revive the economy after the depression was removed

when normalcy returned.

It supports national

businesses against foreign competition and restrictions but will be unmerciful

if they run into trouble. Bank failures

in the USA are very common and the FDIC’s statistics reveal 3560 bank failures

since 1934. Many prominent

multinationals of yester years ( Pan-Am, Chrysler, Chase Manhattan Bank) had

disappeared or have lost their identity. Both share and stake holders are

expected to manage their risk and protect them from failures as there will be minimal

government interference.

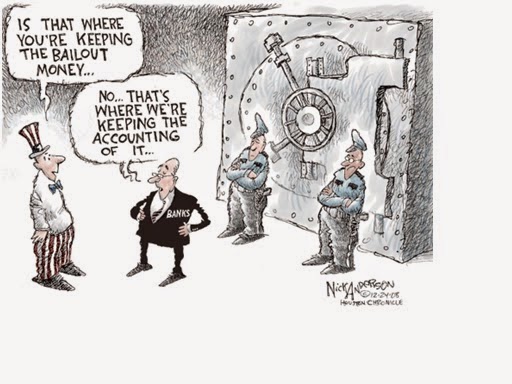

“They should pay for their irrational exuberance”, cried the

conservatives who opposed the US government efforts to bail out the scandalous big fish like Citicorp, AIG,

Goldman Sachs and a few others during

the 2008 financial crisis. The US

Congress approved a rescue package of 700 billion dollars as a temporary cure

for the crisis because of its contagion impacts, but made it clear that it will

not set a precedent for a government bailout in future. A few corporations who availed of the rescue

funding have already repaid part amount.

http://www.shiftfrequency.com

The US government operates like a business house. Extreme steps such as shutting down the

functions of the Government like an industrial lock out are common. President Obama shut down the Federal

government for 16 days in Oct/2013 when the Congress refused to provide extra

funds to run the government. Eight government

shutdowns were recorded in the last 40 years. Detroit city was declared bankrupt

in 2014 due to lack of funds. These actions will never take place anywhere in

the rest of the world. Hire and fire

policy is widely practiced with no exception even to top ranking CEOs. Unceremonious sacking of Vikram Pundit, CEO of

CitiGroup who rescued it from bankruptcy is the recent example.

Will this philosophy which religiously follows the Darwin’s

theory of “Survival of the fittest” fly in India?

The hangover of government control and support is still

strong among the public. This

philosophy will be disliked by politicians as it will put a stopper into their

personal and party kitty. A decade ago, India was under heavy pressure from the

West to liberalise its banking sector. Nobel laureate Joseph Stiglitz complimented

India for resisting pressure to deregulate. She was able to maintain her economic balance during

the global turmoil in 2008, thanks to the stubbornness of the then RBI Governor

Dr.Y.V. Reddy. Hasty deregulations by

aping the USA will only complicate the system and make corruption totally

untenable as our law enforcement machinery

is weak.

“Inclusive growth”, the recent Mantra adored y India, is

diametrically opposite to Laissez –faire. Many sops under this programme are aimed to

capture vote banks. The word ‘inclusive’ has a complex meaning and dimension in

India, not just confined to economic backwardness. Inclusive Growth may temporarily reduce

inequality but will add more to the prevailing lethargy and will be counterproductive

in the long run. India is still confused

about a suitable economic model. Many of her policies have become ineffective

due to cutting a middle path to satisfy everyone. India is a typical middle path monger.

Anglo Saxons will gun down a limping horse but Indians will

not.

Although successful and admired, pure laissez-faire is a

misfit for a soft and developing country like India where stakeholders prevail

over shareholders. It can have only an information value in economics text

books. India needs fair trade not the Anglo Saxon style of free trade.

Dr. Krishnan Arunachalam

Ref: The

Great Depression by Don Nardo

www.wikipedia.com

(Published in Mylopore Club Magazine Mar/2015)

No comments:

Post a Comment